Donate Box 3 Properties to the Children

In this article, we explain how you can optimally use the current low rates of gift tax to avoid your children potentially having to pay high inheritance tax on your estate in the distant future.

Father and mother own in box 3:

- Property A with a WOZ value of €1,000,000

- Properties B and C, each with a WOZ value of €500,000 and they have 2 children.

2024

This year, 2024, the total WOZ value of these three properties is €2,000,000. If the parents die this year, how much would the children pay in inheritance tax?

The rates of inheritance tax in 2024 are (rounded), per child:

- Exemption of €25,000

- 10% on the next €150,000

- 20% on the remainder

Never miss an article from Jan-Jaap

Join 250+ people and sign up for the newsletter and receive Jan-Jaap's articles directly in your email.

2048

But what if the parents die several decades from now? The inheritance tax could (and in my opinion, will) be significantly higher. For example, rounded to 50%.

The rates of inheritance tax in 2042 are (possibly), per child:

- 50% on the assessed value of the properties

This means that each child would then pay 50% on the value of those properties as inheritance tax. The value of the properties will surely have increased over the years, let's assume a doubling. Each child would then pay: 50% on €2,000,000 is €1,000,000. To be able to pay that tax, they would have to sell the properties.

Start gifting the properties in 2024

But how do you gift properties in (annual) parts? You divide each property into 10 equal economic shares. An economic share is a share in the economic ownership of a property. Economic ownership means: not the legal / official owner (cadastre), but the person entitled to the annual rental income (economic yield) from that property. Each of these 10 shares of economic ownership entitles you to 10% of the rental income. Of course, 100 participations can also be issued, each entitling to 1% of those rental incomes. We call these 10 shares in the economic ownership of a particular property 'PARTICIPATIONS'. There are 3 properties that we are going to divide into economic ownership participations.

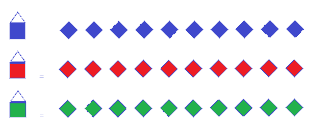

We then have:

- 10 participations A (property A) each worth €10,000

- 10 participations B, €5,000 per participation

- 10 participations C, also valued at €5,000 each.

Establishment of a limited partnership

To be able to gift these participations in a practical way to the children, a limited partnership (CV) is established. This is a collaboration agreement that is registered with the Chamber of Commerce. A private foundation is established that becomes the managing partner of this CV. The parents become the silent partners. It is established that the CV will manage the properties. At the start moment, the parents are the legal owners of the 3 properties (properties are registered in the parents' names) and also the economic owners. They are indeed entitled to the full rental income from the three properties. The 30 participations are all with both parents. They can now decide to gift €150,000 worth of participations to both children in 2024. They can do this as they wish, in consultation with the children, who must accept the gift. This year, 5 participations A and 20 participations property B are gifted to the son. To the daughter: 5 participations A and 10 participations property C. 5 participations property A has a total value of €50,000 and 20 participations in property B or C are each worth a total of €100,000. Each child is then gifted €150,000 this year.

How is this gift taxed this year?

First, 10.4% transfer tax must be paid. Economic transfer is a real transfer and transfer tax is due on it: 10.4% over €150,000 = €15,600. It concerns a gift to the children.

If you gift €150,000 to a child, then the gift tax, due to the exemption, will be under €15,000.

Conjunction: reconciling transfer tax and gift tax

The tax system has a favorable arrangement specifically for these situations, where transfer tax AND gift tax would have to be paid. You only need to pay the highest of these two taxes. The transfer tax must be paid. The gift tax comes out lower than the amount of the transfer tax and therefore does not need to be paid at all. If the amount of the gift tax turns out to be higher than the transfer tax, then the transfer tax must be paid and the gift tax, to the extent that it is higher than the transfer tax. For this reason, gifting up to a maximum of €150,000 per year is recommended. If you gift more this year, then this higher part quickly falls into the high rate of 20% gift tax.

In 7 years, gift all participations to the children in a tax-advantaged way

In our example of a father and mother who want to gift the value of €2,000,000 box 3 properties to their two children, keep in mind that you should gift participations in the properties for at least 7 years to be the most tax-advantaged. This involves taking into account:

- annual appreciation of the properties

- changing tax regulations

Managing the properties and the rental income

Finally, it's important to realize that you are transferring economic ownership of the properties. In life, you remain the legal owner and decide on the properties. You determine the tenants and you can sell properties. The sales profit is then divided among the (owners of the) participations (the economic owners).

To set up a CV fully tailored to your wishes, we advise setting up a foundation from the outset that becomes the managing partner of the CV.

Contact Amsterdam Lawyers

We would be happy to discuss all the possibilities and options with you.

With a limited partnership, gift box 3 properties in annual parts to the children in a tax-advantaged way.

| Description | Amount |

|---|---|

| One-time: establishment costs | |

| - Discussion and advice | €1,000.00* |

| - Establishment of foundation (managing partner) | €500.00* |

| Annually | |

| - Discussion of the tax situation of that year | |

| - Drafting agreements for the gifting of participations (economic transfer) properties to the children | €500.00* |

| * listed prices are exclusive of 21% VAT |

Amsterdam Lawyers

Contact Jan Jaap Geusebroek from Amsterdam Lawyers:

- www.amsterdam-lawyers.nl

- [email protected]

- Tel./ 06-23821224

45-minute advice session with Jan-Jaap

Looking for someone to review your issue? For only €100 you get 45 minutes of advice from Jan-Jaap.